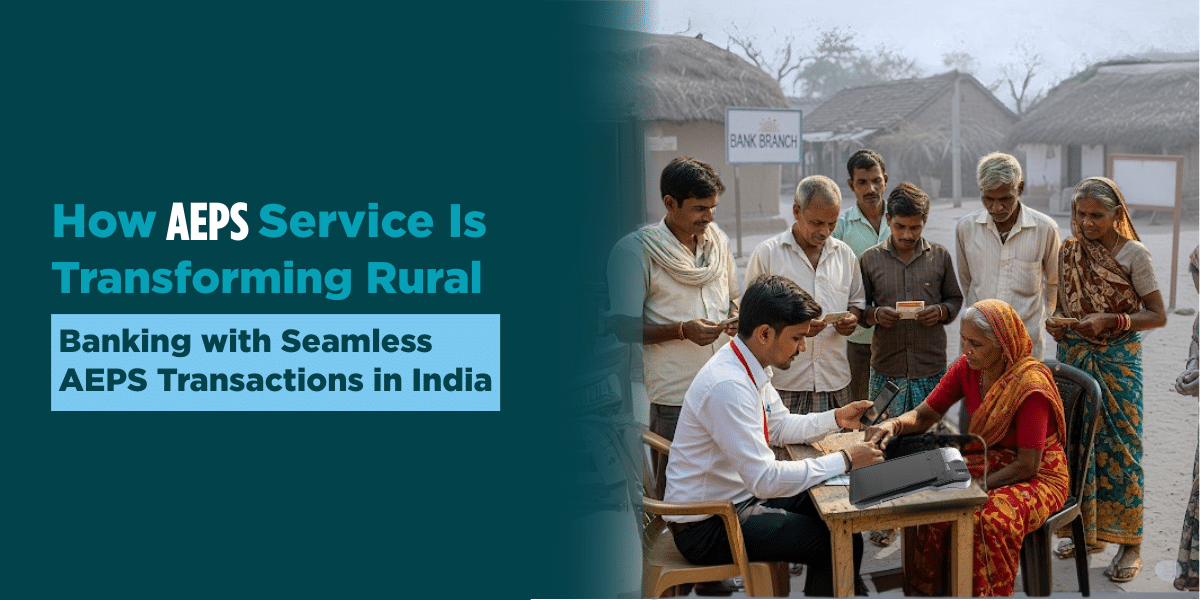

The Indian fintech ecosystem is witnessing a grassroots revolution. At the center of this evolution stands the Aadhaar Enabled Payment System (AEPS), a transformative force reshaping how millions in rural India access and manage banking services. With AEPS services, digital financial inclusion is no longer a vision, it’s an accelerating reality, especially with advancements introduced by tech pioneers like Evolute Fintech Innovations.

Bridging the Bharat-Banking Gap: The Role of AEPS Services

Despite India being the world’s largest democracy with a rapidly digitizing economy, over 65% of the population resides in rural areas where traditional banking infrastructure has often failed to reach. According to a NABARD Financial Inclusion Survey (2024), 29% of rural households still lack easy access to formal banking institutions.

This gap has been addressed head-on by the AEPS service, which enables interoperable, Aadhaar-authenticated financial transactions through micro-ATMs. All one needs is an Aadhaar number, a linked bank account, and biometric verification.

As per NPCI data (June 2024):

| Metric | Value |

| Monthly AEPS Transactions | 49.3 crore |

| Total Transaction Value | ₹62,375 crore |

| Growth YoY (2023-24) | 18.4% |

This robust surge underlines the growing dependency on AEPS for last-mile financial connectivity.

The Seamless Simplicity: Inside AEPS Transactions

An AEPS transaction simplifies banking operations into four core services:

- Cash Withdrawals

- Balance Inquiries

- Mini Statement

- Fund Transfers (to linked Aadhaar accounts)

These services are offered through Bank Mitras or Business Correspondents (BCs) operating micro-ATM devices. Evolute’s MicroATM and MPOS solutions empower these agents with real-time, secure, and biometric-verified transactions.

Fintech at the Forefront: Evolute’s Contribution

At the heart of this rural transformation lies Evolute Fintech Innovations, a company designing robust fintech solutions that directly enable AEPS transactions across India’s remotest districts. Products like:

- MicroATM with AEPS

- Biometric-enabled Smart POS

- Rugged Android Terminals with AEPS integration

- Mini ATMs with fingerprint and iris authentication

These are revolutionizing last-mile banking by ensuring fast, offline-capable, and secure digital access even in connectivity-starved regions.

“Technology is best when it brings people together.”

Evolute embodies this spirit by creating hardware and software ecosystems that connect unbanked populations to formal financial systems.

Why AEPS is a Game-Changer in Rural India

-

No More Branches, Only Access

With AEPS services, villagers no longer have to travel 15–20 km to the nearest bank branch. Instead, doorstep banking is made possible through BCs with Evolute terminals.

-

High Trust, Low Literacy Barrier

The use of biometrics and Aadhaar eliminates PINs and passwords, enabling even non-literate citizens to conduct transactions safely. According to a 2025 NASSCOM-BCG report, 72% of AEPS users in Tier 4 and rural zones cited it as the most trusted banking method.

-

Financial Resilience Post-Pandemic

COVID-19 accelerated the dependency on digital and contactless services. AEPS stepped in as a resilient tool for disbursing welfare schemes like PM-KISAN, MGNREGA, and Direct Benefit Transfers (DBTs).

| Scheme |

AEPS Disbursed (₹ Cr) – FY 2024 |

|

PM-KISAN |

₹7,432 Cr |

|

MGNREGA |

₹4,911 Cr |

| Pension + DBT Subsidies |

₹12,387 Cr |

Source: Ministry of Rural Development (MoRD), June 2024

Secure, Scalable, Sustainable: The Fintech Future

What makes AEPS even more relevant in 2025 is its alignment with India Stack and the Digital Public Infrastructure (DPI) vision. It is scalable, interoperable, and built for low-cost, high-volume usage.

Data Security and KYC Compliance

With growing concerns around data privacy, Evolute’s devices come embedded with:

- STQC-certified fingerprint scanners

- L1 biometric encryption

- Real-time KYCs and eKYC validations

This ensures compliance with RBI’s Digital Payment Security Controls (April 2024) and enhances trust for both banks and rural users.

What Experts Say

“India’s AEPS infrastructure is among the most inclusive financial ecosystems in the world. It’s a model that other emerging economies are now studying.”

“The simplicity of AEPS transactions has created a banking revolution in rural belts. Evolute’s multi-mode, interoperable terminals are enablers of this shift.”

From Bharat to Digital India: A Concluding Thought

In a country where financial inclusion is not just a policy but a necessity, AEPS services offer the key to unlocking banking access for millions. As the sector matures, innovations from firms like Evolute Fintech Innovations are shaping a future where no Indian is left unbanked.

As we look ahead, the seamless AEPS transaction infrastructure backed by Aadhaar, built with robust fintech hardware, and powered by inclusive vision will form the backbone of Digital India 2.0.

Ready to power rural banking with Evolute? Explore more on our Fintech Innovations page and see how your business can lead the AEPS revolution.

Key Takeaways:

- AEPS service has emerged as a revolutionary tool enabling instant biometric-based banking in remote rural regions.

- India saw over 2.4 billion AEPS transactions in FY 2024, indicating deep rural penetration and adoption.

- AEPS significantly reduces dependency on physical bank branches and ATMs, bridging the last-mile gap.

- Evolute Fintech Innovations is enabling secure AEPS services through smart biometric and micro-ATM devices like IMFast, FinBox, and MicroATM MAX.

- The fusion of AEPS with IoT and Aadhaar infrastructure ensures both financial inclusion and transaction integrity.

- Government schemes and DBT programs are being efficiently disbursed via AEPS, empowering rural citizens with transparency and accessibility.